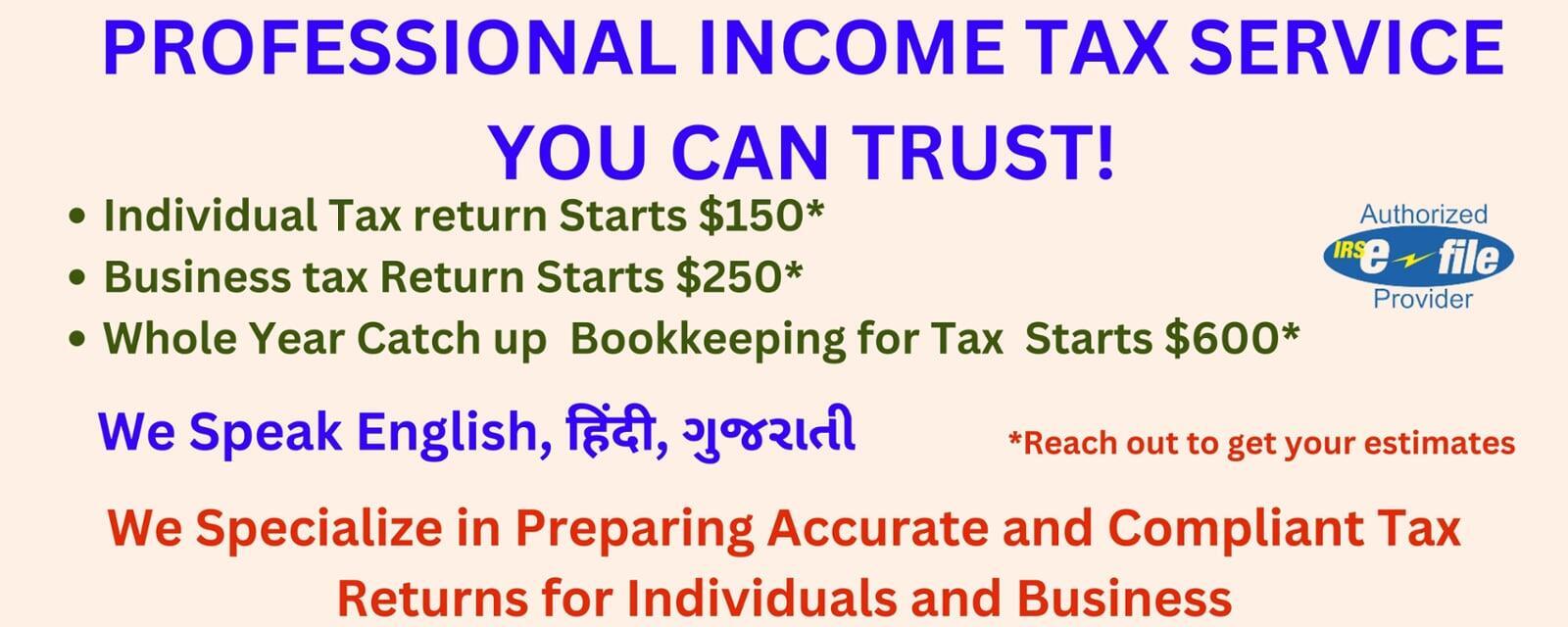

Tax Preparation Services

Tax Preparation Services Pricing Table

| Service Type | Basic Plan | Standard Plan | Premium Plan |

|---|---|---|---|

| Individuals | Starting at $150 | Starting at $300 | Starting at $500 |

| Businesses | Starting at $250 | Starting at $500 | Starting at $1,200 |

Service Inclusions for Individuals:

| Feature | Basic ($150+) | Standard ($300+) | Premium ($500+) |

|---|---|---|---|

| Federal Tax Return Filing | ✅ | ✅ | ✅ |

| State Tax Return Filing (Multi State Included) | ✅ | ✅ | ✅ |

| W-2 & 1099-INT, 1099-DIV Income Reporting | ✅ | ✅ | ✅ |

| Itemized Deductions (Schedule A) | ❌ | ❌ | ✅ |

| Investment Income (Schedule B) | ❌ | ✅ | ✅ |

| Rental Property Income (Schedule E) | ❌ | ✅ | ✅ |

| Self-Employment Income (Schedule C), 1099-NEC, 1099-MISC Reporting | ❌ | ✅ | ✅ |

Foreign Bank Account Reporting (FBAR) | ❌ | ✅ | ✅ |

| Foreign Account Tax Compliance Act (FATCA) | ❌ | ❌ | ✅ |

| Passive foreign investment companies (PFICs) (Foreign Mutual Funds) | ❌ | ❌ | ✅ |

| Priority Support | ❌ | ❌ | ✅ |

| IRS Support | ❌ | ❌ | ✅ |

Service Inclusions for Businesses:

| Feature | Basic ($250+) | Standard ($500+) | Premium ($1,200+) |

|---|---|---|---|

| Federal & State Tax Filing | ✅ | ✅ | ✅ |

| Single-Entity Return (LLC, S-Corp) | ✅ | ✅ | ✅ |

| Partnership LLC , C-Corp (Inc) | ❌ | ✅ | ✅ |

| Multiple-State Filing | ❌ | ✅ | ✅ |

| Depreciation Schedules | ❌ | ✅ | ✅ |

| Quarterly Estimated Tax Calculations | ❌ | ✅ | ✅ |

| IRS Support | ❌ | ❌ | ✅ |

| Year-Round Consultation | ❌ | ❌ | ✅ |

Additional Services (Available at Extra Cost):

- Bookkeeping Services

- Payroll Processing

- Business Tax Consulting

- Tax Amendment Filing

When it comes to tax preparation, our services are tailored to meet your unique needs. Our team of experienced professionals is dedicated to ensuring that you receive the maximum tax benefits while staying compliant with all regulations. From filing your annual tax return to providing strategic tax planning advice, we're here to guide you through every step of the process.

Our individual tax preparation services include a comprehensive review of your financial documents to identify all eligible deductions and credits. We also offer personalized advice on ways to minimize your tax liability and maximize your refund. Whether you're a salaried employee, self-employed individual, or have complex investment income, we have the expertise to handle your tax needs efficiently and accurately.

With our commitment to excellence and client satisfaction, you can trust us to deliver reliable and professional tax preparation services. Contact us today to schedule a consultation and let us help you navigate the complexities of individual tax preparation with ease.